How you doing everyone this is one of Mr short dollar tutorial informative videos where we could discuss scheduling Iris form 1040 basically the itemize deductions how to fill it out and how it explained as well again I will get a lot of people reaching out to us in regards to you know itemized reduction especially people thinking about different things that they actually can write out for their taxes and you know those being itemized deductions they comply for their uh taxes especially charitable donations things like that but I want to do is introduce the form explain to you exactly what it the purpose of it is give you some common deductions and also to explain to you when it's used when it cannot be used and also High transitions back to your IRS form 1040 for your tax return okay basically what you see right here is the itemized deduction list that bi uh Iris form scheduling for the 10 40. these are the different sections medical and dental expenses taxes you paid interest you pay gifts and charity casual stuff and losses other itemized deduction you total itemized deduction right here on line 17 okay and basically the purpose of this form is used to list itemized deductions those itemized deductions are used when the total of the itemized deduction is larger than the standard deduction given by the IRS used by the local and then it's used to lower your tax free income okay what we'll look at right here is I'm gonna go to go to actually uh let me get right here first for you if you see right here to your left right here you see the standard deduction that bottom left hand corner what I mean by that if you...

PDF editing your way

Complete or edit your instructions 1040 fill anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs instructions schedule a form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 2021 schedule a form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs instructions 1040 schedule form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Instructions 1040 (Schedule A)

About Form Instructions 1040 (Schedule A)

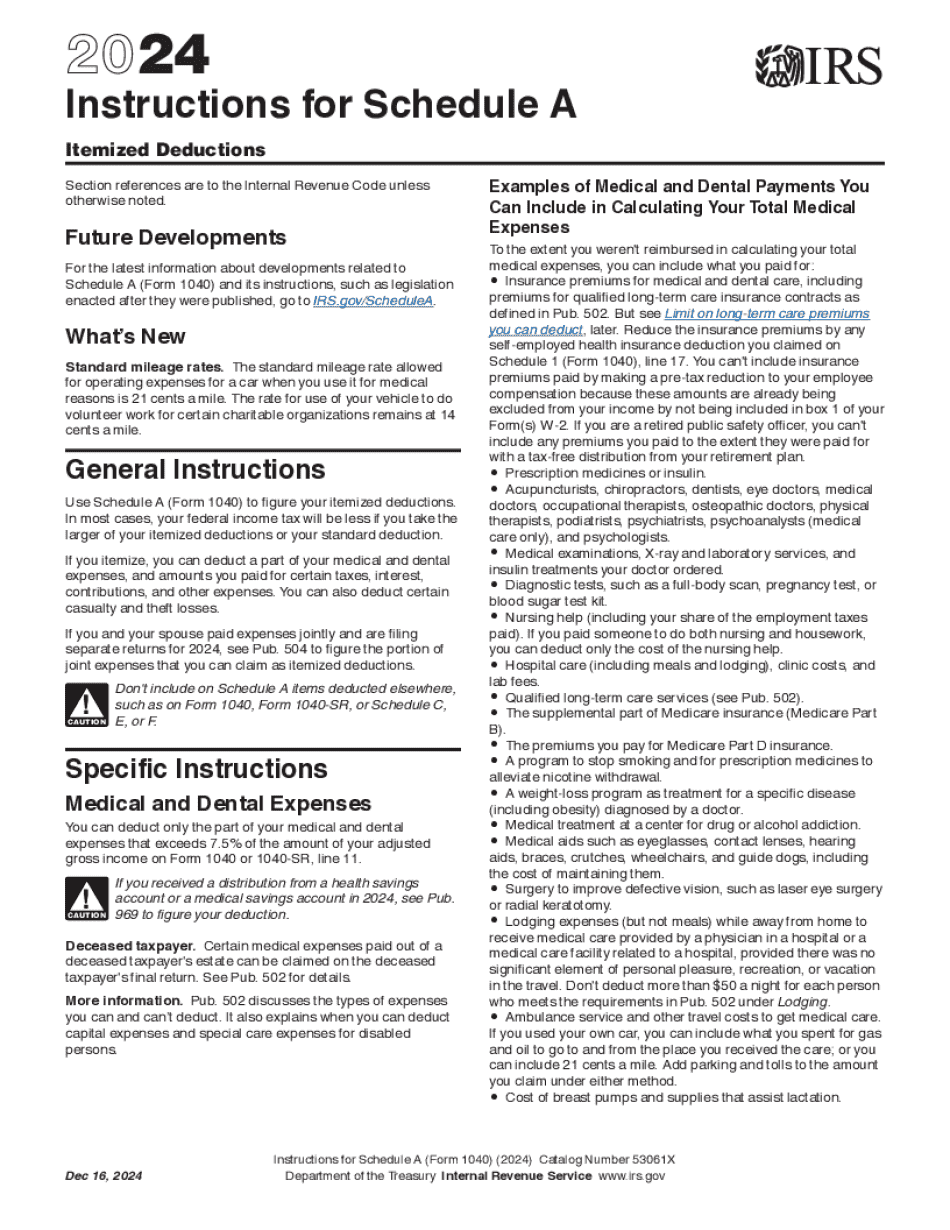

Form Instructions 1040 (Schedule A) is a set of guidelines provided by the Internal Revenue Service (IRS) for individuals who are required to report itemized deductions on their federal income tax return. Schedule A is used to report various deductions such as medical expenses, mortgage interest, charitable donations, state and local taxes, and miscellaneous expenses. Taxpayers who have more itemized deductions than the standard deduction provided for their filing status, or for those who incurred significant expenses that they want to claim deductions for, may need to use Schedule A. Taxpayers who are self-employed or have a small business with expenses can also benefit from using Schedule A to claim deductions for expenses related to their business operations.

What Is 2025 irs instructions a form?

Online technologies make it easier to arrange your document management and increase the efficiency of the workflow. Follow the quick guide so that you can fill out Form 2025 instructions a form?, stay clear of errors and furnish it in a timely manner:

How to complete a 1040 schedule a instruction 2019?

-

On the website hosting the form, choose Start Now and pass towards the editor.

-

Use the clues to fill out the relevant fields.

-

Include your individual information and contact details.

-

Make sure you enter appropriate details and numbers in appropriate fields.

-

Carefully revise the content of your blank as well as grammar and spelling.

-

Refer to Help section in case you have any questions or contact our Support team.

-

Put an digital signature on your Form 2025 instructions a form? printable using the support of Sign Tool.

-

Once blank is completed, press Done.

-

Distribute the ready via email or fax, print it out or download on your gadget.

PDF editor makes it possible for you to make modifications to the Form 2025 instructions a form? Fill Online from any internet connected device, customize it in line with your requirements, sign it electronically and distribute in different means.

What people say about us

Become independent with electronic forms

Video instructions and help with filling out and completing Form Instructions 1040 (Schedule A)