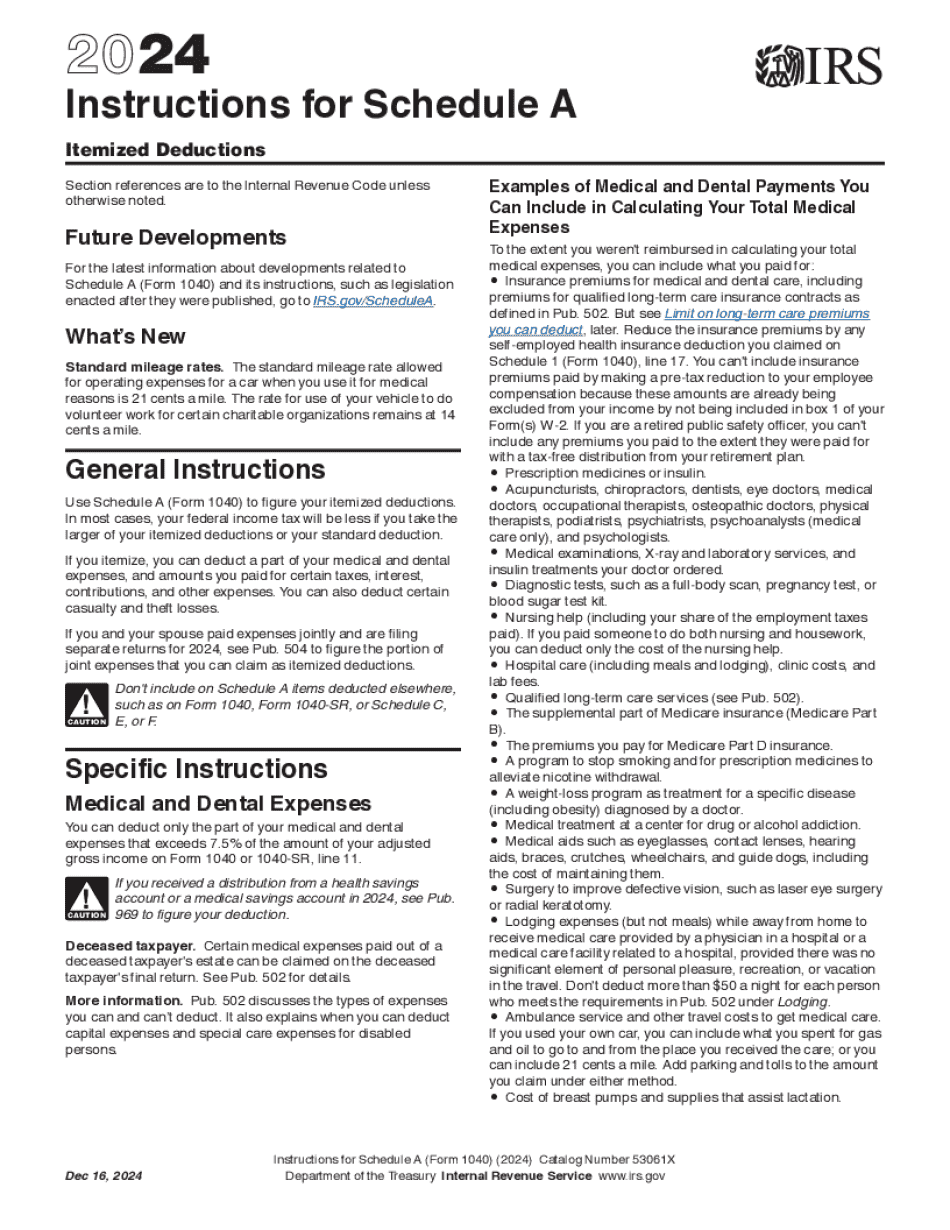

Welcome to another www.oxfordonlineenglish.com eyes deduction the Schedule A here is to report your itemized deduction now which one do you go with the standard deduction or the analyzed deduction and the answer is you want to go with the deduction that gives you the larger dollar amount now as you'll notice the Schedule A is divided into different sections here each section has a category of things you can idolize we'll take a closer look at these right now so the first section is medical and dental expenses you can itemize all your medical and all your dental expenses now there are certain limits to what you can itemize which we'll go over later second section as taxes you pay for example you can itemize state and local income taxes or general sales taxes you can also itemize real estate taxes and personal property taxes third section is interest you've paid now the interest is going to deal with the mortgage interest in points for section just to charity this section any losses through casualty or theft sixth section job expenses and certain miscellaneous deductions and lastly other miscellaneous deductions so all the deductions that are added up goes in this section right here box 29 the total itemized deduction so once you have the total itemized deduction you wanna then report that on the 1040 so let's go to the 1040 and I'll show you where you can enter the itemized deductions so on the 1040 you want to go to the second page and up here box number 40 box number 40 right here it says itemized deduction from Schedule A or your standard deduction so you wanna put the total itemized deduction right here now remember if the standard deduction is larger than the itemized deduction...

Award-winning PDF software

Itemized deductions worksheet 2025 Form: What You Should Know

You won't pay more tax on Schedule A. 20 Aug 2025 – 2025 Tax Returns Do Not Have to Be Adjusted for Changes in the Standard Deduction, Standard Child Tax Credit, and the 2025 and 2025 Changes to the FICA Bonus Credit 2-3-4 20 Aug 2025 — You will not pay the higher FICA tax rate. 20 Aug 2025 — The current return doesn't need to be adjusted for the changes. 15 Feb 2025 — The 2025 tax return is no longer to be adjusted for the changes or the 2016-17 increase in the standard deduction. 8-9-10 This change happens if your modified adjusted gross income changed, if your AGI has become over 60,000 (130,000 if married filing joint), changes in the maximum adjusted gross income, or you changed to filing a joint return with a spouse (the two of you have to file jointly if married filing a joint return). If you were a nonresident alien for your entire taxation year, but not present for at least 183 days, file form 8829-PR and submit it to the IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1040 (Schedule a), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1040 (Schedule a) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1040 (Schedule a) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1040 (Schedule a) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Itemized deductions worksheet 2025