Award-winning PDF software

Travis Texas Form Instructions 1040 (Schedule A): What You Should Know

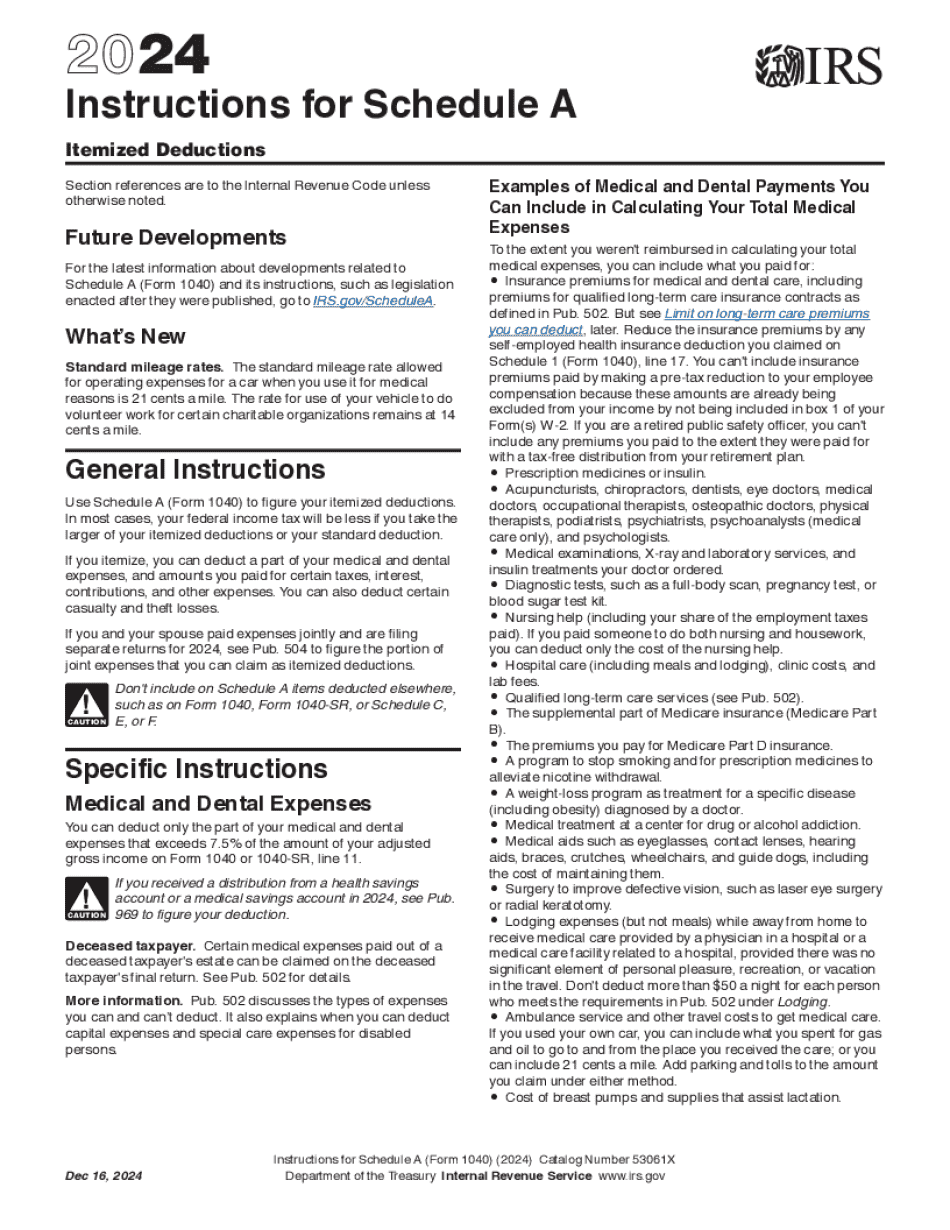

West 7th Floor, Austin, Texas 78. Use the form to establish the assumed name for a corporation, partnership, limited liability company, or limited liability partnership for state or local tax purposes. Other Ways to Establish An Assumed Name A certificate issued by the Secretary of State verifying the legal existence of a corporation, limited liability company, or limited liability partnership and a certificate issued by the Secretary of State verifying the legal existence of a foreign limited liability company, incorporated in Texas, may also be presented to establish an assumed name. If the State or foreign limited liability company has not been incorporated in Texas and if the certificate of existence has not been obtained from the Texas Secretary of State, the form is not valid form. Any fee charged for the issuance or validation of documents shall be paid to the Department of State. Franchise Tax for Manufactured Homes If certain conditions are met, you may elect to have the Franchise Tax for Manufactured Homes apply to your sales of manufactured homes. This tax must be paid by the end of February of each year after you have made the election. When the deadline approaches, visit the Motor Vehicle Division of the Texas Comptroller's website under “Taxation.” 2021 Instructions for Schedule A — Itemized Deductions — IRS 2021 Instructions for Schedule A — Itemized Deductions — Texas Comptroller Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the largest of your itemized deductions. Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal tax will be understated if you use the method of tax computation called the “back-end” method. Taxpayers using the “front-end” method are still subject to the tax. You must complete a sales and use tax statement, and must attach it to your return. The form is available in person through a tax sales professional. You may also call the Department of Revenue at or toll-free at. Taxpayers with incomes over 100,000, married taxpayers filing joint returns, and filers with disabilities can obtain a certificate of eligibility or a certificate of exemption from the Department of Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Travis Texas Form Instructions 1040 (Schedule A), keep away from glitches and furnish it inside a timely method:

How to complete a Travis Texas Form Instructions 1040 (Schedule A)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Travis Texas Form Instructions 1040 (Schedule A) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Travis Texas Form Instructions 1040 (Schedule A) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.